Artificial intelligence and human-computer cooperation platform

Cloud-Walk focuses on every scene of people's life, based on artificial intelligence technology and human-computer cooperation platform, and user-centered, defines the scene oriented, industrial and personalized intelligent services.

Smart identity solution

In order to make up for the shortcomings of traditional authentication, Cloud-Walk proposes intelligent authentication solution from science and technology: using multi-dimensional intelligent decision engine.

The highest confidence level of intelligent identification is 99.999999%, and the financial security is raised to a new level. Using a variety of biometric technologies, such as face recognition, fingerprint recognition, finger vein recognition, voiceprint recognition, iris recognition and traditional user password, SMS verification code and other security mechanisms, combining different channels, transaction codes, trading habits, trading periods, counterparties, trading places and other big data to analyze the transaction attributes of users, and intelligently formulate different authentication rules, Meet the needs of different scenarios.

Smart bank outlet solution

Through systematic analysis of the overall and surrounding environment of the bank outlet, according to the analysis results, make a comprehensive layout design of the structure, moving line, layout, equipment, etc. in the outlet, integrate the environment of the outlet, and create the most practical plan. From the beginning of entering the bank, customers can truly perceive the wisdom brought by smart outlets: natural path planning, clear and eye-catching signs, independent business selection and processing, and customized exclusive financial services for customers. Through the combination of software and hardware, the integration of online and offline, convenient interaction between financial products and information, intelligent guidance and brand-new customer experience, big data application and mining, etc. are realized to help the bank build an intelligent business network under the "new marketing" mode.

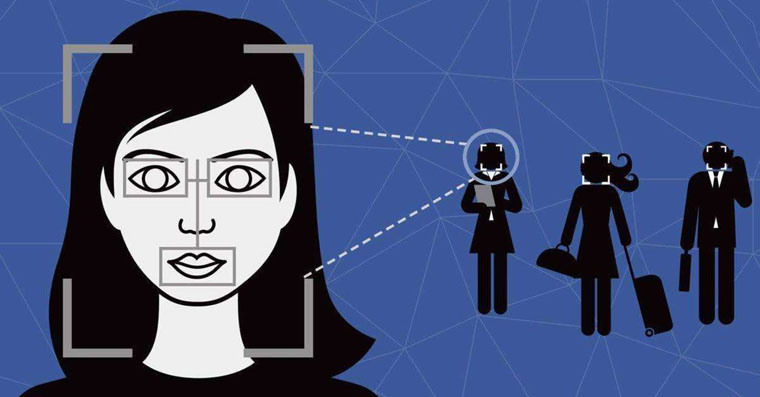

Smart KYC solution

Cloud-Walk launched face recognition acceleration service from technology: using the CPU + GPU server computing architecture, making core computing such as face recognition parallel processing in GPU, improving the system's concurrent computing capacity. The number of concurrent computing of a single server reached more than 400 / s, and cooperating with the application of cluster, providing a good solution for the high concurrent industry demand. Cloud-Walk is based on 1:n face recognition technology, which is high-performance, high scalability, high availability and high elasticity. It is widely used in high experience, dynamic and non perceptual personnel recognition solutions.

Security solutions for smart Park

With the development of deep artificial intelligence technology, Internet of things technology and big data technology, Cloud-Walk technology is committed to the construction of AI enabling park. Based on the self-developed double-layer heterogeneous deep neural network face recognition technology, it integrates attendance, access control, dining, visitors, meetings and other businesses, and creates an intelligent and convenient AI management platform for the comprehensive park, serving all kinds of parks, offices and hospitals , schools, government agencies, etc. provide one-stop intelligent park solutions. At the same time, the system realizes monitoring and warning for strangers and cross-border personnel, comprehensively improves the security level of the park, and leads the park into a new era of AI prevention and control.

Risk control solution of credit

Cloud-Walk provides a scenario based overall risk control solution for credit business based on big data technology and artificial intelligence modeling technology, adopts joint operation mode, constructs a full life cycle credit business risk control system for the financial credit field, and customized risk control model runs through the whole credit business. According to the risk preference and demand of customers, it provides packages in different life cycles of the project Including business consultation, transaction structure design, customized risk control modeling, localized deployment of risk control system, system docking, operation management, etc., to help the bank quickly launch business and control the whole process risk. At the same time, we should carry out business extension and deep integration with the bank, cultivate the independent risk control ability of the bank, and finally build a customized risk control decision-making system of the bank.